This week we covered several topics related to fundamentals of corporate finance. Between BUS501 and ACC505 courses we learned about the building blocks of financial reporting (accounting equation, income statement, balance sheet, and cash flow statement), simple and compound interest, annuities versus perpetuities, and how to calculate time value of money.

Understanding the Three Major Financial Statements

Every business relies on a set of financial statements to evaluate its performance and make informed decisions. Financial accounting records the financial transactions of a business and communicates this information to potential investors and creditors. The output of the accounting process are the financial statements (Alldredge, 2017).

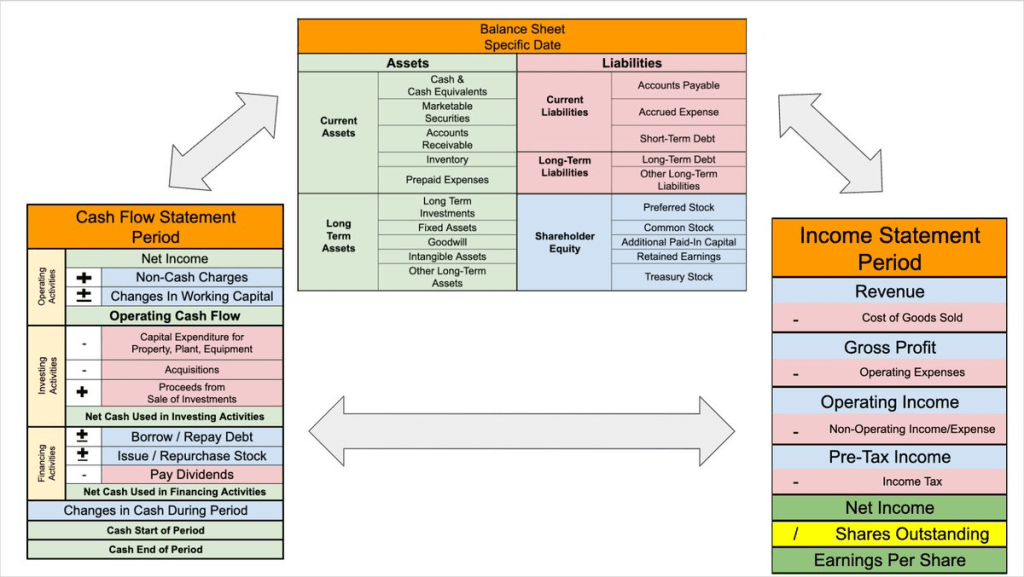

The Income Statement shows a company’s revenues and expenses over a specific period, revealing the net profit or loss. Answers the question: Are you profitable?

The Balance Sheet provides a snapshot of a company’s financial position at a given point in time, including its assets, liabilities, and shareholders’ equity. Answer the question: What’s your net worth?

Finally, the Cash Flow Statement tracks the inflows and outflows of cash, detailing how well a company manages its cash to fund operations and growth. Answer the question: Are you generating cash?

The following figure shows a nice overview of these three statements (Schmidt, n.d.):

Each of these statements gives stakeholders insight into the health and viability of a business. Investors use them to assess the potential return on investment, while creditors might use them to evaluate the risk of lending money. Understanding how these financial statements interact and provide different perspectives is key to making informed business decisions. Following figure provides a nice view of the layouts and how the three major financial statements are interrelated (Feroldi, 2022):

Time Value of Money, Annuities, and Perpetuities

The time value of money (TVM) is a fundamental concept in finance, stating that money available today is worth more than the same amount in the future due to its potential earning capacity. This is why interest rates and discounting are so important since they adjust for the difference in value over time. One common application of TVM is through annuities and perpetuities.

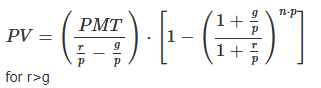

An annuity refers to a series of fixed payments made or received at regular intervals over a specific period. Many financial products, such as retirement accounts or student loans, are structured as growing annuities where payments increase at a set percentage each period, reflecting inflation or expected income growth. While annuities are often thought of in the context of annual payments, many can be sub-annual (e.g., monthly or quarterly) to match more frequent financial transactions. For example, student loans or retirement funds may be structured with payments that grow in line with expected income growth. Perpetuities, on the other hand, are similar but last forever, providing an infinite series of payments. Perpetuities are mostly theoretical, but can be applied to businesses and real estate in practice.

There’s a whole bunch of formulas to calculate present value (PV), future value (FV), rate (r), number of years of payments (n) and the number of payments per year (p), but they all stem for these three equations where p will be 1 where there’s only 1 payment per year (MBA Math, n.d.).

Present value of money:

Growing Perpetuity Present Value

Annuity Present Value

References:

Alldredge, D. (2017). Interpreting Corporate Financial Statements [Video]. YouTube. https://www.youtube.com/watch?v=lI4dkIEvPFM

Build the MBA math, spreadsheet, and accounting skills you’ll need: Annual time value of money. (n.d.). MBA Math. https://www.mbamath.com/

Feroldi, B. (2022, September 18). How to analyze a balance sheet, income statement & cash flow statement in less than 10 minutes. The 3 Financial Statements. Retrieved from https://www.upcarta.com/resources/65108-how-to-analyze-a-balance-sheet-income-statement-cash-flow-statement-in-less-than-

Schmidt, J. (n.d.). Three financial statements. Corporate Finance Institute. https://corporatefinanceinstitute.com/resources/accounting/three-financial-statements/